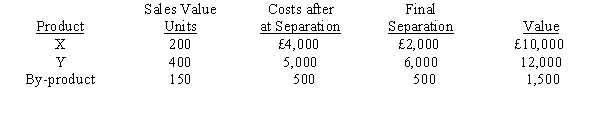

Nelson SA. obtains two products and a by-product from its production process. By-product revenues are treated as other income and a noncost approach is used to assign costs to them. During the period, 1,200 units were processed at a cost of £12,000 for materials and conversion costs, resulting in the following:  Required:

Required:

a.

Account for all costs using a physical basis for allocation.

b.

Account for all costs using net realizable value as the basis for allocation.

c.

Account for all costs using final sales value as the basis for allocation.

d.

How much joint costs should be allocated to the by-product?

Definitions:

Procedural Self

Patterns of behavior that are characteristic of an individual.

Declarative Self

The aspect of an individual's self-concept that consists of factual information about the self, such as traits, preferences, and experiences.

Self-Esteem

Self-esteem is an individual's overall subjective evaluation of their own worth.

Self-Concept

An individual's perception of themselves, including beliefs about one's capabilities, appearance, and personality.

Q3: Information about three joint products follows: <img

Q4: A selling division produces components for a

Q15: Mulholland Company manufactures various wooden furniture products.

Q23: What is the role of transfer pricing

Q39: Direct costs<br>A) can be assigned to cost

Q44: Ramon Company reported the following units of

Q45: Toshi Company incurred the following costs in

Q55: A _ is a secondary product recovered

Q110: Opportunity cost is best defined as<br>A)how much

Q184: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2787/.jpg" alt=" The graph