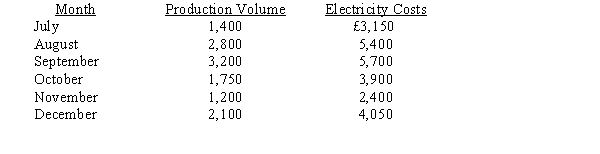

The following information is available for electricity costs for the last six months of the year:  Using the high-low method, estimated variable cost per unit of production is

Using the high-low method, estimated variable cost per unit of production is

Definitions:

Direct Labor-Hours

The total hours worked by employees that are directly involved in the production process, serving as a measure for allocating labor costs to products or services.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual products based on a certain activity base.

Plantwide Predetermined

A rate calculated by dividing the estimated manufacturing overhead cost by the estimated amount of a cost driver, applied uniformly across a manufacturing plant.

Manufacturing Overhead Rate

A calculation used in costing that allocates indirect manufacturing costs to products based on a predetermined factor, such as machine hours or labor costs.

Q3: Goal congruence means<br>A) there is alignment of

Q3: Refer to Figure 21-3. The value-added costs

Q12: Refer to Figure 20-1. The minimum transfer

Q18: Which of the following costs is an

Q20: Which of the following methods of assigning

Q22: Selling and administrative costs are classified as<br>A)

Q25: Jensen Company produced 10,000 cases of cookies

Q48: Taylor Company's budgeted sales were 10,000 units

Q59: Which of the following costs is a

Q71: Refer to Figure 17-5. Ebola's variable overhead