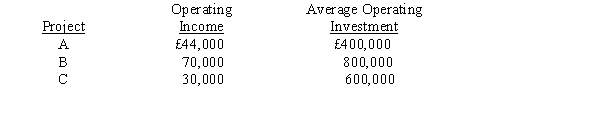

The following information is provided:  Assume the division's current ROI is 10 per cent and the firm's minimum required rate of return is 8 per cent. If you were the division manager and you were evaluated based on ROI, which projects would you accept?

Assume the division's current ROI is 10 per cent and the firm's minimum required rate of return is 8 per cent. If you were the division manager and you were evaluated based on ROI, which projects would you accept?

Definitions:

Dividend Prospects

The potential for future dividend payments from investments, often assessed to evaluate the attractiveness of stocks.

Future Interest Rates

Expected rates of interest in the future, affecting everything from loans to investments.

Abnormal Return

The difference between the actual return of an investment and the expected return based on the risk and market's overall returns.

Sales Increase

An upward movement in the quantity sold or the revenue generated from the sale of a product or service over a specific period.

Q5: Refer to Figure 15-5. How many pillows

Q6: Refer to Figure 19-4. What is the

Q7: The word "Kaizen" is Japanese for:<br>A) materials

Q16: A cost used up in the production

Q17: Refer to Figure 17-8. Noelle's variable overhead

Q29: The overhead rates of the traditional-based approach

Q34: Refer to Figure 19-2. If Northern's average

Q58: Refer to Figure 21-2. The value-added costs

Q72: Over the LONG-TERM, prevention costs are expected

Q72: Dusty Company manufactures oak porch swings. Budgeted