Mills Company uses standard costing for direct materials and direct labour. Management would like to use standard costing for variable and fixed overhead.

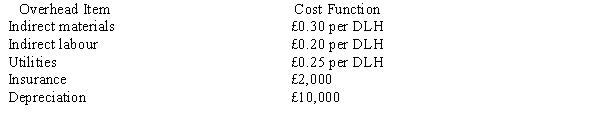

The following monthly cost functions were developed for overhead items:  The cost functions are considered reliable within a relevant range of 70,000 to 100,000 direct labour hours. The company expects to operate at 80,000 direct labour hours per month.

The cost functions are considered reliable within a relevant range of 70,000 to 100,000 direct labour hours. The company expects to operate at 80,000 direct labour hours per month.

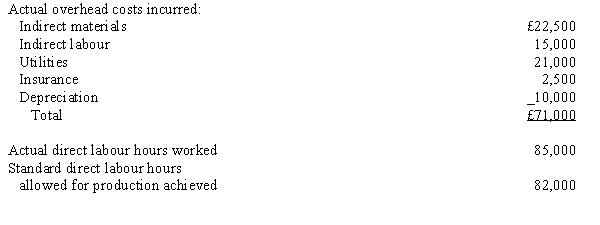

Information for the month of September is as follows:  Required:

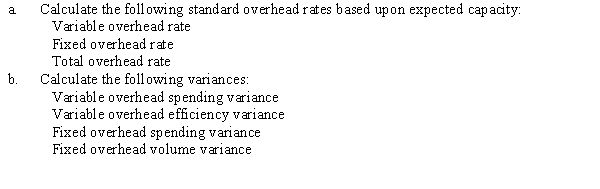

Required:

Definitions:

Predetermined Overhead Rate

Predetermined Overhead Rate is a rate calculated before a period begins, used to allocate estimated overhead costs to products or job orders based on a selected activity base.

Annual Overhead Costs

Refers to the total expenses that are not directly tied to a specific product or service but are required for the business to operate, accumulated over a year.

Direct Labor Costs

The wages paid to workers who are directly involved in the production of goods or the provision of services.

Indirect Labor

Labor costs associated with support work that does not directly contribute to the manufacture of products or the provision of services, such as maintenance and supervisory wages.

Q3: Refer to Figure 21-3. The value-added costs

Q5: Refer to Figure 20-6. Assume the Jones

Q7: The industrial value-chain analysis<br>A) recognizes only complex

Q8: Control risk is the risk that an

Q20: Refer to Figure 17-1. Max's materials price

Q25: The volume variance is caused by:<br>A) the

Q26: Resources that are only purchased precisely at

Q31: Products might consume overhead in different proportions

Q39: In a simple least-squares regression where X

Q54: Variances indicate<br>A) the cause of the variance.<br>B)