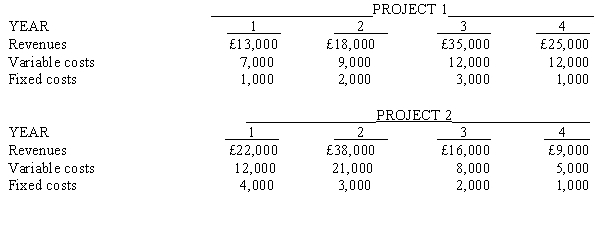

Maxim, Inc., is considering two mutually exclusive projects. Project 1 requires an investment of £40,000, while Project 2 requires an investment of £30,000. Cash revenues and cash costs for each project are shown below.  The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

Required:

a.

Determine the net present value of EACH project using a 16 per cent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

Definitions:

Dominant Allele

An allele that expresses its phenotypic effect even when heterozygous with a recessive allele.

Genotype

The genetic makeup of an organism, representing the combination of alleles inherited from its parents.

Phenotype

The assortment of detectable features in an individual, formed through the combination of their genetic material and the influence of environmental conditions.

Genotype Frequencies

The proportion of different genetic types within a population.

Q16: The monitoring of a plan's implementation is

Q17: If total warehousing cost for the year

Q18: Which of the following is the first

Q20: A budget based on additions and subtractions

Q22: Profit centre managers would be evaluated based

Q22: Which of the following items would be

Q25: An auditor's begins the identification of business

Q32: A PA in a large firm has

Q43: An independent auditor must consider whether the

Q47: Refer to Figure 11-2. What is the