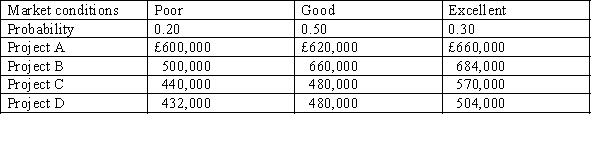

Figure 12-2

ZX Company is faced with choosing from the following four mutually exclusive alternatives. Each project has the same duration and the cash flows are expected to occur at the same point in time. Their net cash inflows will be determined by the prevailing market conditions. The forecast net cash inflows and their associated probabilities are shown below:

-Refer to Figure 12-2. The expected value of Project D is:

Definitions:

Substitution Effect

The change in consumption patterns due to a change in the prices of goods, leading consumers to replace more expensive items with cheaper alternatives.

Income Effect

The change in an individual's or economy's income and how that change will affect the quantity demanded of a good or service.

Opportunity Cost

The lost potential gain from other alternatives when one alternative is chosen.

Income Effects

The changes in an individual's or economy's income and how that changes their spending and saving behavior.

Q3: According to the profession's rules of conduct,

Q8: Refer to Figure 20-10. What is the

Q20: In which of the following circumstances would

Q20: A first audit requires more work than

Q30: Product costs are converted from cost to

Q30: (Memorandum required)<br>Simon Enterprises is considering the purchase

Q35: A critical element of control is monitoring.What

Q38: In Canada, when there has been a

Q43: Compare and contrast traditional organization-based costing with

Q70: Refer to Figure 13-5. The present value