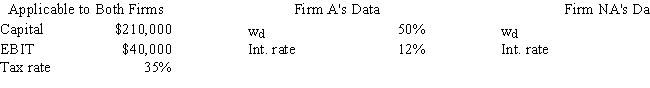

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.

?

Definitions:

Competence

Refers to the ability of an individual to effectively perform or execute a particular task or role to a specified standard or expectation.

Autonomy Needs

Refers to the degree to which an individual desires the freedom to make choices and decisions independently.

Autonomous Motivation

A form of intrinsic motivation where individuals engage in behavior out of genuine interest or personal endorsement of its value.

Equity Theory

A theory of motivation that focuses on individuals' perceptions of fairness in exchange relationships, emphasizing the importance of achieving equity between an individual's input and outcomes.

Q13: Sub-Prime Loan Company is thinking of

Q39: Gray Manufacturing is expected to pay a

Q40: An important part of the capital budgeting

Q42: For a typical firm,which of the following

Q47: Southwest U's campus book store sells course

Q50: Atlanta Cement,Inc.buys on terms of 2/15,net 30.It

Q68: Norris Enterprises,an all-equity firm,has a beta of

Q80: The cash flows associated with common stock

Q88: In theory,capital budgeting decisions should depend solely

Q91: Assume that the economy is in a