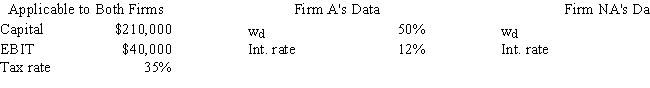

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical--they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e. ,what is ROEA - ROENA? Do not round your intermediate calculations.

?

Definitions:

Empathetic Agent

A software entity designed to understand and react to human emotions, often used in customer service and interactive applications.

Embedded Operator

An integral part or function within a system or software that is designed to perform specific operations or tasks automatically.

Intelligent Personal Assistant

Software designed to perform tasks or services for individuals.

Augmented Reality

A combination of our normal sense of the objects around us with an overlay of information displayed.

Q1: Poulsen Industries is analyzing an average-risk

Q22: Suppose the exchange rate between U.S.dollars and

Q31: Which of the following is CORRECT?<br>A) Firms

Q32: Which of the following statements is CORRECT?

Q38: Datta Computer Systems is considering a

Q74: The announcement of an increase in the

Q75: Which of the following statements is CORRECT?<br>A)

Q79: The two methods discussed in the text

Q89: Kirk Development buys on terms of 2/15,net

Q130: When adding a randomly chosen new stock