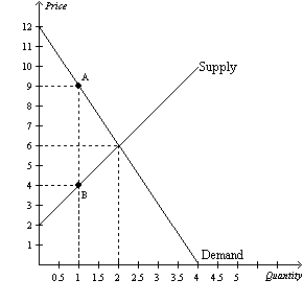

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The per-unit burden of the tax on sellers is

Definitions:

Fixed Cost

Describes expenses that do not change with the level of production or business activity, such as rent, salaries, and insurance premiums.

Variable Cost

Costs that change in proportion to the good or service that a business produces.

Total Cost

The complete cost of production, including both fixed and variable costs.

Average Variable Cost

The cost per unit of producing goods or services that changes with the level of output, including costs like labor and materials, divided by the quantity of output produced.

Q9: Refer to Figure 8-2. The amount of

Q65: When a tax is imposed on a

Q71: An increase in the size of a

Q100: Refer to Figure 7-21. When the price

Q169: A tax on a good<br>A)gives buyers an

Q270: The world price of a ton of

Q345: Refer to Figure 8-10. Suppose the government

Q377: Refer to Figure 8-2. The per-unit burden

Q397: When a tax is levied on buyers,

Q431: Refer to Figure 9-23. Producer surplus with