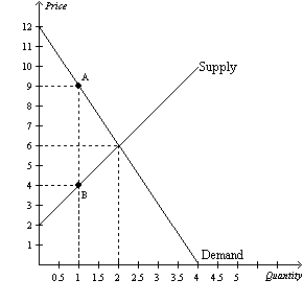

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The loss of producer surplus associated with some sellers dropping out of the market as a result of the tax is

Definitions:

Monopolist

An individual or entity that is the sole provider of a particular good or service, possessing significant control over market prices and output.

Price Discrimination

A pricing strategy where a seller charges different prices for the same product or service to different customers, based on factors like demand, income level, or purchase volume.

Marginal Revenue

The additional income generated from the sale of one more unit of a product or service.

Marginal Cost

A rephrased definition: The expense incurred in the manufacture or production of an additional quantity of a product or service.

Q39: Refer to Figure 8-2. Consumer surplus without

Q93: The benefit to sellers of participating in

Q134: Domestic producers of a good become worse

Q153: Refer to Table 7-15. If each producer

Q195: Refer to Figure 9-22. With free trade,

Q202: When a tax is levied on a

Q219: Refer to Figure 8-9. The amount of

Q281: Refer to Figure 7-30. If the market

Q354: Taxes create deadweight losses.

Q394: Refer to Figure 8-18. Suppose the government