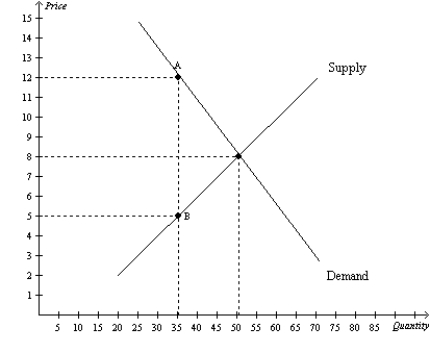

Figure 8-4

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-4.The amount of deadweight loss as a result of the tax is

Definitions:

Variable Costs

Expenses that adjust in proportion to the amount of production or the intensity of business operations.

Fixed Costs

Expenses that remain constant regardless of the amount of production or sales, including rent, salaries, and insurance.

Finished Goods Inventory

The inventory of finished goods available for sale but have not been bought by consumers yet.

Cost Of Goods Manufactured

The total cost incurred by a company to produce goods during a specific period, including costs of materials, labor, and overhead.

Q12: In terms of gains from trade, why

Q128: When a country allows trade and becomes

Q156: Refer to Figure 8-10. Suppose the government

Q170: The most important tax in the U.S.

Q328: A tax on an imported good is

Q368: Total surplus measures the<br>A)loss to buyers from

Q398: When a tax is placed on a

Q413: Inefficiency can be caused in a market

Q414: Refer to Figure 7-32. If the government

Q465: Refer to Figure 8-14. Which of the