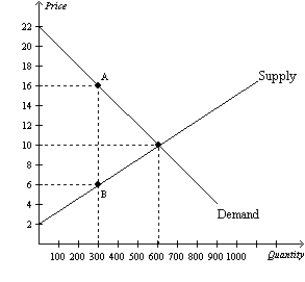

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.Without a tax,producer surplus in this market is

Definitions:

Variable Costs

Expenses that change in proportion with the level of business activity or production volume, such as raw materials and direct labor costs.

Target Income

The desired profit level that a company aims to achieve within a specific period, often used in budgeting and financial planning.

Contribution Margin

The amount of revenue remaining after subtracting variable costs, used to cover fixed costs and generate profit.

Mixed Costs

Expenses that have both a fixed and variable component, changing in total with the level of activity but also including a constant element.

Q11: The supply curve for whiskey is the

Q41: Refer to Scenario 9-2. Suppose the world

Q103: Refer to Figure 8-22. Suppose the government

Q284: Refer to Figure 8-24. For an economy

Q290: Refer to Figure 8-9. The producer surplus

Q401: Refer to Figure 8-4. The per-unit burden

Q423: What happens to the total surplus in

Q469: Refer to Figure 8-14. Which of the

Q483: A tax placed on a good<br>A)causes the

Q493: Refer to Figure 8-3. Which of the