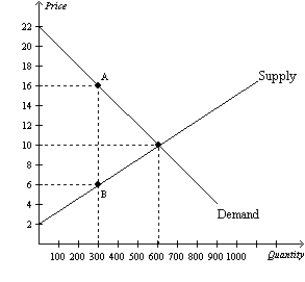

Figure 8-6

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-6.When the tax is imposed in this market,producer surplus is

Definitions:

Collateral

Property or assets pledged by a borrower to secure a loan, subject to seizure on default.

Third-Party Beneficiary

A person who is not a party to a contract but who has the right to enforce it because the parties to the contract made the contract with the intent to benefit him.

Implied

Something not explicitly stated but understood to be included or involved through indirect indications or logical inference.

Statute of Frauds

A legal concept that requires certain types of contracts to be in writing and signed by the party to be charged, in order to be enforceable.

Q95: If the government imposes a $3 tax

Q116: Producer surplus is the area<br>A)under the supply

Q121: Assume the supply curve for diapers is

Q207: Suppose that the market for product X

Q225: Assume, for Mexico, that the domestic price

Q282: If the United States legally allowed for

Q334: For any country, if the world price

Q398: Suppose the nation of Canada forbids international

Q435: Suppose the government places a per-unit tax

Q458: Economists disagree on whether labor taxes have