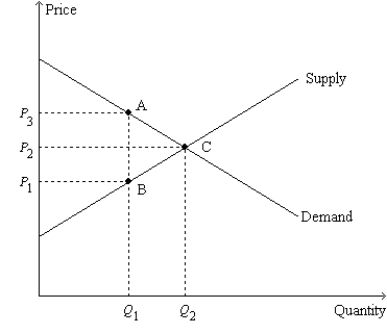

Figure 8-11

-Refer to Figure 8-11.Suppose Q1 = 4;Q2 = 7;P1 = $6;P2 = $8;and P3 = $10.Then the deadweight loss of the tax is

Definitions:

Monopolist

A market participant that is the sole seller of a good or service, thereby controlling its market.

Income

The money received by an individual or entity, typically in exchange for labor or investment.

Total Cost Function

A mathematical formula that describes the total cost incurred by a firm in the production of goods or services as a function of output level.

Price-Discriminating Monopolist

A monopolist that charges different prices to different consumers or groups of consumers for the same product, to maximize profits.

Q38: The government's benefit from a tax can

Q118: If a tax shifts the demand curve

Q170: The most important tax in the U.S.

Q237: In the market for widgets, the supply

Q251: Refer to Figure 8-4. The price that

Q360: In which of the following circumstances would

Q388: Refer to Figure 8-18. Suppose the government

Q414: Refer to Figure 7-32. If the government

Q425: Refer to Table 7-5. Which of the

Q426: Refer to Table 7-12. The equilibrium market