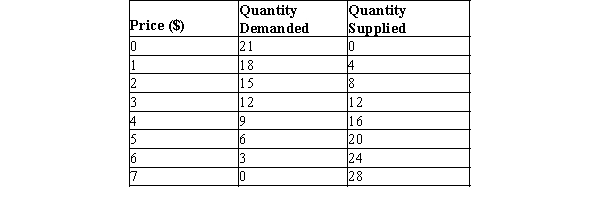

Table 6-6

-Refer to Table 6-6. If the government set a price floor at $2, would there be a shortage or surplus, and how large would be the shortage/surplus?

Definitions:

Dependency Exemption

A tax deduction available to taxpayers for each qualifying dependent, reducing the taxable income. It has been suspended for tax years 2018 through 2025 under the 2017 Tax Cuts and Jobs Act.

Qualifying Child

A dependent who meets specific IRS criteria related to relationship, age, residency, and support, affecting tax benefits.

Tests

Examinations or assessments used to measure knowledge, skills, abilities, or performance.

Basic Standard Deduction

A set dollar amount that reduces the income on which you are taxed, varying according to filing status, available to all taxpayers who do not itemize deductions.

Q127: Suppose the demand for peanuts increases. What

Q149: Refer to Figure 6-4. A government-imposed price

Q181: A simultaneous decrease in both the demand

Q217: Refer to Figure 6-31. Suppose that a

Q304: Refer to Figure 6-31. If the government

Q369: Congress intended that<br>A)the entire FICA tax be

Q405: Refer to Figure 6-11. Which of the

Q406: A tax imposed on the buyers of

Q444: Rent controls only affect the demand side

Q450: A tax on sellers shifts the supply