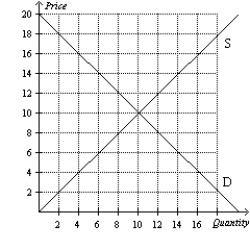

Figure 6-33

-Refer to Figure 6-33.Suppose a $3 per-unit tax is imposed on the sellers of this good.What price will buyers pay for the good after the tax is imposed?

Definitions:

Overapplied Overhead

A situation where the allocated manufacturing overhead cost is more than the actual overhead incurred.

Underapplied Overhead

An instance in which the budgeted manufacturing overhead expenses fall short of the real overhead costs experienced.

Estimated Direct Labor

The forecasted amount of labor cost directly associated with the production of goods or services.

Predetermined Overhead Rate

A rate used to allocate indirect costs to different products or job orders based on a pre-established criterion, such as labor hours or machine hours.

Q182: Refer to Figure 6-5. Suppose the market

Q212: If the government removes a tax on

Q220: When there is a technological advance in

Q224: There are several criticisms of the minimum

Q340: Refer to Figure 6-17. A government-imposed price

Q465: A price ceiling set below the equilibrium

Q479: A seller's willingness to sell is<br>A)measured by

Q519: Which of the following statements is correct?<br>A)Buyers

Q611: A tax on buyers will shift the<br>A)demand

Q648: Refer to Figure 6-36. If the government