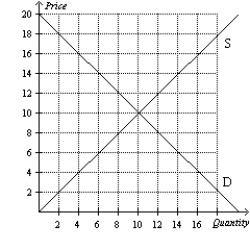

Figure 6-33

-Refer to Figure 6-33.Suppose a $3 per-unit tax is imposed on the sellers of this good.How much is the burden of this tax on the sellers in this market?

Definitions:

Perfectly Inelastic

Describing a situation where the quantity demanded or supplied of a good does not change in response to a price change.

Demand Curve

A graphical representation of the quantity of a good that consumers are willing and able to purchase at various prices during a given period.

Cross-Price Elasticity of Demand

A measure indicating how the quantity demanded of one good or service changes in response to a price change of another good or service.

Cross-Price Elasticity of Demand

The sensitivity measure of one good's demanded quantity to the price changes of a separate good.

Q29: If a binding price floor is imposed

Q91: Kristi and Rebecca sell lemonade on the

Q240: Refer to Table 7-9. If the market

Q278: When a tax is placed on the

Q283: Another way to think of the marginal

Q300: Pat bought a new car for $15,500

Q308: Refer to Figure 7-14. If the government

Q341: If the demand for light bulbs increases,

Q433: If a price ceiling is not binding,

Q579: Refer to Figure 6-14. If the horizontal