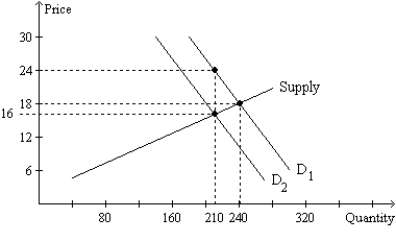

Figure 6-24

-Refer to Figure 6-24.What is the amount of the tax per unit?

Definitions:

Business Operations

Activities involved in the day-to-day functions of a business related to producing and delivering its goods and/or services.

Noncash Assets

Assets that are not in the form of cash or easily convertible into cash, such as real estate, equipment, and investments.

Capital Balances

The amounts of money that individuals or entities have invested in a company, reflected in their ownership or partnership accounts.

Cash Distribution

The allocation of funds or payment of dividends to a company's shareholders typically in the form of cash.

Q6: Suppose sellers of perfume are required to

Q171: Sellers of a good bear the larger

Q178: Refer to Figure 6-33. Suppose a $4

Q282: Which of the following is not an

Q406: A tax imposed on the buyers of

Q417: The incidence of a tax is<br>A)always determined

Q445: A price ceiling is always a binding

Q529: Refer to Figure 6-10. A price ceiling

Q582: Refer to Table 6-2. A price floor

Q604: To say that a price ceiling is