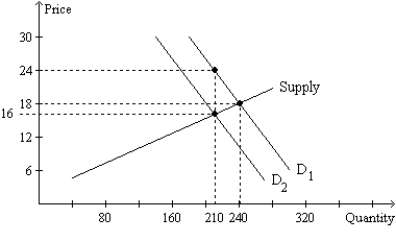

Figure 6-24

-Refer to Figure 6-24.The per-unit burden of the tax on buyers of the good is

Definitions:

Security Interest

A legal claim or lien on collateral that has been pledged, usually to secure repayment of a loan.

Debtor

A Debtor is an individual or entity that owes money or has financial obligations to another party, known as the creditor.

Secured Party

An individual or entity that holds an interest in a collateral to secure repayment or performance of an obligation.

Authenticated Security Agreement

A legal document that verifies a security interest in collateral, often required in secured transactions.

Q110: What happens to consumer surplus in the

Q122: Which of the following is correct? A

Q126: Which of the following is not correct?<br>A)Economists

Q156: If the supply curve is more price

Q174: An advantage of using the midpoint method

Q365: When free markets ration goods with prices,

Q395: Refer to Figure 7-1. If the price

Q490: A tax on the buyers of sofas<br>A)increases

Q624: Refer to Scenario 6-2. Suppose the government

Q642: A tax on buyers shifts the demand