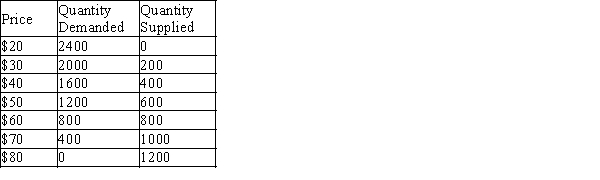

Table 6-1

-Refer to Table 6-1. Suppose the government imposes a price ceiling of $40 on this market. What will be the size of the shortage in this market?

Definitions:

Progressive

Pertaining to ideas, policies, or attitudes favoring progress, change, improvement, or reform, particularly in social conditions.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by total income.

Marginal Tax Rate

The rate at which your last dollar of income is taxed, indicating the tax rate applied to the next dollar of taxable income.

Excise Tax

Excise tax is a specific type of tax imposed on certain goods, services, and activities, often included in the price of products like tobacco, alcohol, and gasoline.

Q62: If a price floor is not binding,

Q98: The price paid by buyers in a

Q110: A binding minimum wage creates a surplus

Q132: A key lesson from the payroll tax

Q173: If a binding price floor is imposed

Q263: Refer to Figure 6-2. The price ceiling<br>A)is

Q409: Which of the following is likely to

Q476: Since a tax imposed on buyers of

Q556: Opponents of the minimum wage point out

Q626: Economists compute the price elasticity of demand