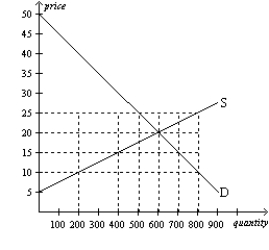

Figure 4-20

-Refer to Figure 4-20.If the price is $10,then there would be a

Definitions:

Put Option

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a certain amount of an underlying asset at a specified price within a specific time frame.

Risk-Free Rate

The theoretical return on an investment with zero risk, often represented by the yield on government securities.

Strike Price

The specified price at which an option contract can be exercised.

Strike Price

The price at which the holder of an option can buy (call option) or sell (put option) the underlying security or commodity.

Q25: Consider the market for portable air conditioners

Q186: Refer to Table 4-15. Assume these are

Q289: If businesses become more pessimistic about the

Q432: A decrease in demand shifts the demand

Q485: Refer to Figure 5-5. The maximum value

Q531: When demand is perfectly inelastic, the price

Q567: Most markets in the economy are<br>A)markets in

Q586: For which pairs of goods is the

Q598: Which of the following would cause price

Q643: When quantity demanded increases at every possible