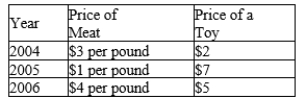

Table 24-5

The table below pertains to Wrexington, an economy in which the typical consumer's basket consists of 20 pounds of meat and 10 toys.

-Refer to Table 24-5. The cost of the basket

Definitions:

Price Increase

A rise in the cost of goods or services over a specific period.

Tax Burden

Tax Burden describes the total amount of tax that individuals, corporations, or other entities must pay, relative to their income or profits.

Excise Tax

A specific duty charged on the sale or consumption of particular goods, such as luxury items, gasoline, and alcohol, which is often aimed at discouraging certain behaviors.

Consumers

Individuals or entities that purchase goods or services for personal use rather than for manufacturing or reselling.

Q38: Which of the following is included in

Q67: A decrease in the price of domestically

Q91: Suppose a basket of goods and services

Q131: Changes in real GDP reflect only changes

Q307: Refer to Table 24-10. If 2009 is

Q309: Refer to Table 23-6. In 2012, this

Q320: Refer to Table 24-3. If 2013 is

Q350: Refer to Table 23-12. Calculate the rate

Q371: If the real interest rate is 5

Q532: Refer to Table 24-15. If the base