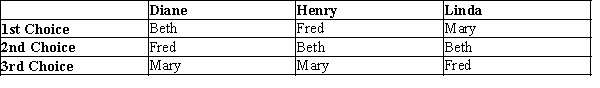

Table 22-15

Diane, Henry, and Linda are voting for who to promote. They can only promote one candidate. Their preferences are given in the table below.

-Refer to Table 22-15. If elections were held where voters choose either Fred or Mary, and then choose either the winner or Beth, what would the results be?

Definitions:

Effective Income Tax Rate

The average percentage of their total income that individuals or corporations pay in taxes, reflecting the actual rate of taxation rather than the nominal tax rate.

Statutory Income Tax Rate

The prescribed rate by law that a company or individual pays on income, differing by country and sometimes by income level or source.

Tax Jurisdiction

The legal authority granted to a government entity to impose taxes on individuals, businesses, or transactions within a defined geographical area.

Permanent Differences

These are differences between taxable income and accounting income that originate in one period and do not reverse subsequently.

Q86: The purchase of rice produced this period

Q160: Total income from the domestic production of

Q202: Economic policy that appears to be ideal

Q211: Refer to Figure 23-1. Which of the

Q248: Teresa faces prices of $6.00 for a

Q389: Refer to Table 22-14. Adams calls and

Q420: Lindsay and Tim are playing the ultimatum

Q455: The classic example of adverse selection is

Q510: Consider the budget constraint between "spending today"

Q558: For Brent, the income effect of a