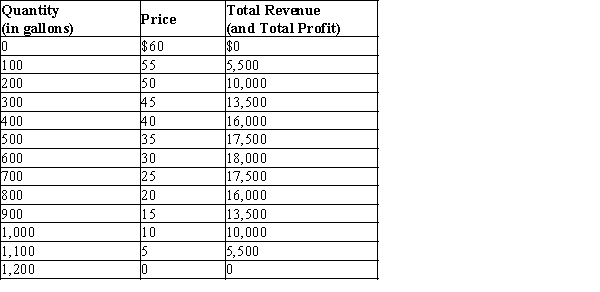

Table 17-1

Imagine a small town in which only two residents, Rochelle and Alec, own wells that produce safe drinking water. Each week Rochelle and Alec work together to decide how many gallons of water to pump. They bring the water to town and sell it at whatever price the market will bear. To keep things simple, suppose that Rochelle and Alec can pump as much water as they want without cost so that the marginal cost of water equals zero. The town's weekly demand schedule and total revenue schedule for water is shown in the table below:

-Refer to Table 17-1. Suppose the town enacts new antitrust laws that prohibit Rochelle and Alec from operating as a monopoly. How many gallons of water will be produced and sold once Rochelle and Alec reach a Nash equilibrium?

Definitions:

Cost Recovery Deduction

A tax deduction that allows taxpayers to recover the cost of property or assets over time through depreciation or amortization.

§179 Expense

A section of the U.S. tax code that allows businesses to deduct the full purchase price of qualifying equipment and/or software within a tax year.

Machinery

Mechanical devices or equipment designed to perform a specific task in industrial, commercial, or agricultural applications.

§179 Expense

A tax code allowing businesses to deduct the full purchase price of qualifying equipment or software within the tax year of purchase.

Q18: A consultant interviews the hiring manager of

Q94: Refer to Scenario 17-2. If each firm

Q139: Refer to Table 17-4. If the market

Q214: The players in a two-person game are

Q241: If duopolists colluded but then stopped colluding,<br>A)price

Q307: Oligopolies would like to act like a<br>A)duopoly,

Q334: Refer to Table 17-32. Is there a

Q364: Refer to Figure 16-13. Use the letters

Q434: Cartels are difficult to maintain because<br>A)antitrust laws

Q486: Refer to Table 17-37. Based upon the