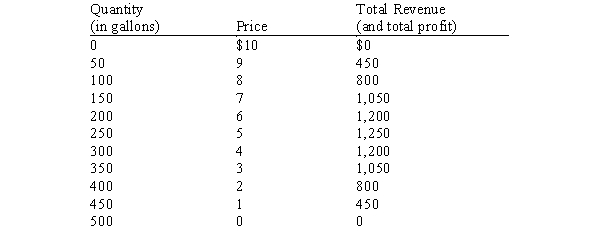

Table 17-4

The table shows the town of Mauston's demand schedule for gasoline. For simplicity, assume the town's gasoline seller(s) incur no costs in selling gasoline.

-Refer to Table 17-4. If there are exactly two sellers of gasoline in Mauston and if they collude, then which of the following outcomes is most likely?

Definitions:

Consignor

The person or entity that owns goods on consignment and sends them to the consignee for sale or display.

Days' Sales in Inventory

A financial metric that measures the average number of days it takes for a company to sell its entire inventory during a given period.

Consignee

The individual or entity to whom goods are shipped to be sold on behalf of the owner, retaining no legal ownership until sales occur.

Expense Recognition Principle

An accounting principle that dictates that expenses should be recognized in the period in which they are incurred to generate revenues, matching expenses against revenues in the period in which the revenue was earned.

Q149: Refer to Scenario 17-5. If the restaurant

Q167: Refer to Table 17-11. If ABC and

Q183: Refer to Scenario 16-7. If YumYum decides

Q196: A firm in a monopolistically competitive market

Q224: Refer to Table 17-12. Suppose there are

Q245: Which of the following would increase the

Q276: Refer to Table 17-21. What is (are)

Q406: Which of the following statements is false?<br>A)The

Q425: A monopolistically competitive firm has the following

Q518: The oligopoly price will be greater than