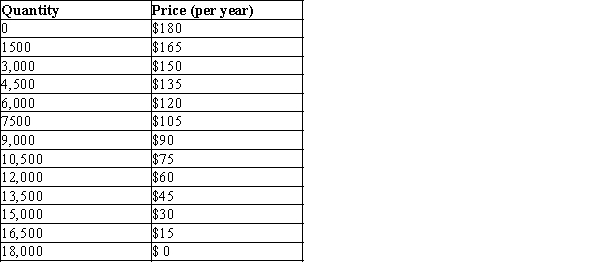

Table 17-5

The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

-Refer to Table 17-5. Assume there are two profit-maximizing digital cable TV companies operating in this market. Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell. What price will premium digital channel cable TV subscriptions be sold at when this market reaches a Nash equilibrium?

Definitions:

Common Stock

A type of equity security that represents ownership in a corporation, entitling holders to vote on corporate matters and receive dividends.

Initial Value Method

An accounting approach where investments are reported at their acquisition cost without subsequent adjustment for changes in market value.

Goodwill

An intangible asset on a company's balance sheet that arises when a company acquires another for a price higher than the fair value of its net tangible assets.

Retained Earnings

The portion of net income that is not distributed as dividends to shareholders, but rather reinvested in the business or kept as reserve.

Q117: Which of the following events could increase

Q121: Refer to Figure 16-3. Which of the

Q174: Firms that spend a large amount of

Q250: Refer to Table 17-21. If Paul chooses

Q261: Which of the following is correct? When

Q338: Refer to Figure 16-13. Which letter represents

Q355: The "competition" in monopolistically competitive markets is

Q364: Refer to Figure 16-13. Use the letters

Q378: Suppose that a college professor is creating

Q591: Free entry eliminates long-run profits for firms