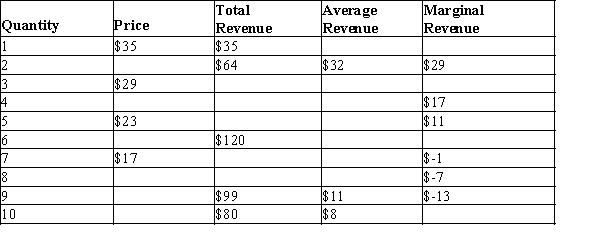

Table 15-1

-Refer to Table 15-1. What is the marginal revenue for the monopolist for the sixth unit sold?

Definitions:

Taxable Income

The portion of an individual's or corporation's income that is subject to taxation by governmental authorities.

Book Income

Book income refers to the amount of income reported by a company in its financial statements according to accounting principles, before any adjustments for tax purposes.

Deferred Tax Liabilities

Future tax payments a company is obligated to pay the government, arising due to temporary differences between its taxable income and its accounting earnings.

Deferred Tax Assets

Future tax benefits obtained due to deductible temporary differences and carryforwards, recognized in financial accounting.

Q71: Refer to Table 15-16. The monopolist has

Q317: Refer to Table 14-15-a. What is the

Q380: Most markets are not monopolies in the

Q414: Refer to Figure 15-4. The average total

Q445: Which of the following is not a

Q458: Which of the following is not a

Q459: Refer to Table 15-11. What level of

Q497: Because monopoly firms do not have to

Q504: Refer to Figure 15-4. If a regulator

Q522: A firm cannot price discriminate if<br>A)it has