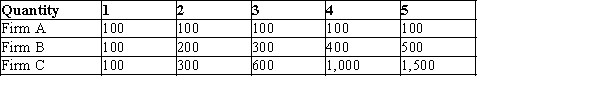

Table 13-20

Listed in the table are the long-run total costs for three different firms.

-Refer to Table 13-20. Firm C is experiencing economies of scale.

Definitions:

Revenue Recognition

The accounting principle that dictates the process and timing of recognizing revenue in the financial statements, typically when it is earned and realizable.

GAAP

Generally Accepted Accounting Principles, a collection of commonly-followed accounting rules and standards for financial reporting in a particular jurisdiction, notably the United States.

Cookie Jar Reserves

Accounting practices where companies set aside reserves during good financial periods to smooth out earnings in future, less favorable periods.

Estimated Obligations

The predicted liabilities or commitments a company expects to incur in the future, often found in financial planning and budgetary processes.

Q6: Refer to Figure 14-7. Suppose AVC =

Q34: Tony's Taco Truck has an average variable

Q36: Refer to Table 13-18. What is the

Q175: Which of the following explains why long-run

Q195: Assume a certain firm regards the number

Q468: Since the 1980s, Wal-Mart stores have appeared

Q502: Which of the following represents the firm's

Q507: Mrs. Smith operates a business in a

Q552: Refer to Figure 14-2. If the market

Q601: Refer to Table 13-20. Firm B is