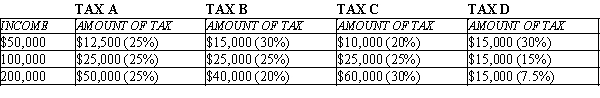

Table 12-22

-Refer to Table 12-22. A regressive tax is illustrated by tax

Definitions:

Deferred Tax Liability

A tax obligation due in the future for income that has been recognized in the financial statements before it is taxable by tax authorities.

Tax Depreciation

The depreciation expense deducted for tax purposes, allowing taxpayers to recover the cost of a property or asset used in a trade or business for income-producing purposes.

Accounting Depreciation

Represents the systematic allocation of the depreciable amount of an asset over its useful life, reflecting the wear and tear, obsolescence, or other declines in value as an expense in the income statement.

Company Tax Rate

The rate at which a corporation's income is taxed by the government.

Q45: Which of the following is not a

Q113: Elephants are endangered, but cows are not

Q206: In many cases, tax loopholes are designed

Q265: Four roommates share an off-campus house and

Q275: Total taxes paid divided by total income

Q308: Mike Miller is the town manager of

Q493: Many economists believe that<br>A)the corporate income tax

Q520: Individual income taxes and social insurance taxes

Q606: The notion that similar taxpayers should pay

Q634: All of the following are transfer payments