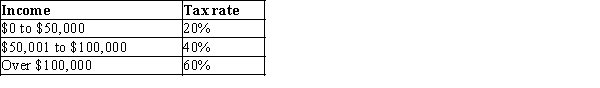

Table 12-5

-Refer to Table 12-5. What is the marginal tax rate for a person who makes $60,000?

Definitions:

Taxable Income

Earnings subject to taxation, which equals gross income minus any allowable deductions and exemptions.

Non-Dividend Paying Corporation

A corporation that chooses not to distribute any part of its earnings to shareholders as dividends, typically to reinvest in the business.

Limited Liability Company

An organizational form that merges the direct taxation benefits of a partnership or sole proprietorship with the limited legal responsibility characteristic of a corporation.

Q248: In order to determine tax incidence, one

Q253: Refer to Table 12-22. A proportional tax

Q255: In order to construct a more complete

Q259: On the Fourth of July, there is

Q265: Four roommates share an off-campus house and

Q322: Refer to Table 11-6. Suppose the cost

Q324: Goods that are not excludable include both<br>A)private

Q389: A television broadcast is an example of

Q406: Vertical equity and horizontal equity are associated

Q642: Which of the following is an example