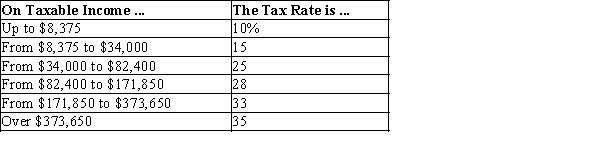

Table 12-10

-Refer to Table 12-10. If Jace has $33,000 in taxable income, his tax liability will be

Definitions:

Activity-Based Costing

Activity-based costing is an accounting method that assigns costs to products or services based on the activities that go into producing them, thereby giving more accurate insights into the costs and profitability of each.

Facility Sustaining Costs

Expenses incurred to maintain the operational capacity of a physical facility or infrastructure, excluding costs related to direct production activities.

Cleaning

The process of removing contaminants, dirt, and impurities from objects and environments, often for maintaining health and hygiene.

Custodial Work

The cleaning, maintenance, and upkeep tasks performed to manage and maintain buildings and facilities.

Q29: Refer to Table 11-2. Suppose the cost

Q89: A person's marginal tax rate equals<br>A)her tax

Q216: Goods that are rival in consumption but

Q267: In what way do public goods give

Q277: For private goods allocated in markets,<br>A)prices guide

Q374: An economics professor, upset about the rising

Q398: Taxes create deadweight loss when they<br>A)distort behavior.<br>B)cause

Q409: The flypaper theory of tax incidence<br>A)ignores the

Q482: Suppose an excise tax is imposed on

Q611: In general, Democrats tend to prefer<br>A)higher marginal