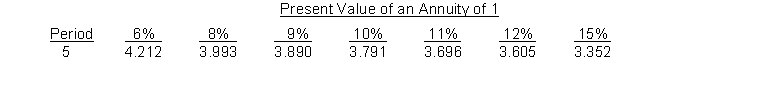

Santana Company is considering investing in a project that will cost $151,000 and have no salvage value at the end of its 5-year life. It is estimated that the project will generate annual cash inflows of $40,000 each year. The company requires a 9% rate of return and uses the following compound interest table:

Instructions

(a) Compute (1) the net present value and (2) the profitability index of the project.

(b) Compute the internal rate of return on this project.

(c) Should Santana invest in this project?

Definitions:

Common Ground

Shared beliefs, values, or interests that make communication more effective and cooperative between parties.

Distract

To divert someone's attention from something to something else, often causing a decrease in focus or concentration.

Close

The conclusion or final part of a document, presentation, or sale, often summarizing key points or calling for action.

Negative Message

Communication that conveys bad news, rejection, or a negative outcome.

Q41: The formula for the materials price variance

Q48: Nance Company is considering buying a machine

Q65: Intangible benefits in capital budgeting<br>A) should be

Q107: An unfavorable labor quantity variance may be

Q157: The comparison of differences between actual and

Q166: In evaluating high-tech projects,<br>A) only tangible benefits

Q170: Why are budgets useful in the planning

Q174: The internal rate of return method differs

Q357: It costs a meat-processing company $50,000 to

Q432: In the early 1980s, U.S. economic policy