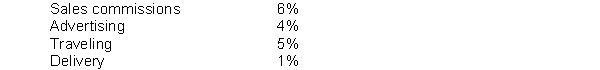

Lapp Manufacturing uses flexible budgets to control its selling expenses. Monthly sales are expected to be from $400,000 to $480,000. Variable costs and their percentage relationships to sales are:

Fixed selling expenses consist of sales salaries $80,000 and depreciation on delivery equipment $20,000.

Instructions

Prepare a flexible budget for increments of $40,000 of sales within the relevant range.

Definitions:

First-In, First-Out Method

A method of inventory valuation where the oldest inventory items are recorded as sold first, with the most recent costs remaining in inventory.

Conversion Costs

The combination of labor and manufacturing overhead costs that are incurred in turning raw materials into finished products.

First-In, First-Out Method

An inventory valuation method where the first items produced or acquired are the first ones sold or used, affecting cost of goods sold and inventory valuation.

Material Costs

The total cost of materials used in the production of goods, including both direct raw materials and indirect materials.

Q71: Total _ costs will be the same

Q92: Argus Company anticipates that other sales will

Q95: Star Industries computes variances as a basis

Q101: The capital budgeting method that allows comparison

Q120: Unfavorable materials price and quantity variances are

Q129: In developing a standard cost for direct

Q153: The discount rate that will result in

Q160: The dollar amount of the controllable margin<br>A)

Q170: The elimination of an unprofitable product line

Q194: Which one of the following items would