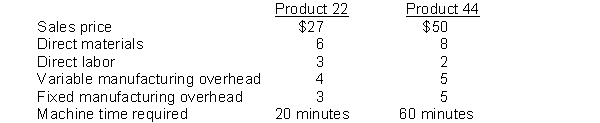

Hewitt Co. has 4,000 machine hours available to produce either Product 22 or Product 44. The cost accounting department developed the following unit information for each product:

Instructions

Management wants to know which product to produce in order to maximize the company's income. Taking into consideration the constraints under which the company operates, prepare a report to show which product should be produced and sold.

Definitions:

Depreciation

The process of allocating the cost of a tangible asset over its useful life, representing the asset's wear and tear, deterioration, or obsolescence.

Units-of-Activity Method

A depreciation technique that calculates the depreciation of an asset based on its usage, activity, or units produced instead of time.

Depreciation Rates

Percentages or methods used to systematically reduce the book value of a tangible asset over its useful life.

Double-Declining-Balance

An accelerated depreciation method that doubles the straight-line depreciation rate, reducing the asset's book value more quickly.

Q13: In the month of June, a department

Q17: Delany Company uses a traditional costing system.

Q48: A shift from high-margin sales to low-margin

Q50: In evaluating the margin of safety, the<br>A)

Q67: In incremental analysis, total fixed costs will

Q71: A _ transfer price is based on

Q74: Boswell Company manufactures two products, Regular and

Q116: Hale Company manufactures two models of its

Q159: Each of the following is a limitation

Q178: A company is deciding on whether to