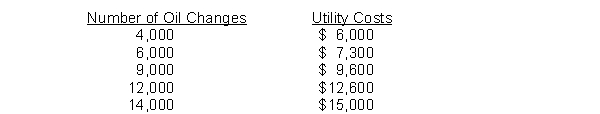

Bill Braddock is considering opening a Fast 'n Clean Car Service Center. He estimates that the following costs will be incurred during his first year of operations: Rent $9,200, Depreciation on equipment $7,000, Wages $16,400, Motor oil $2.00 per quart. He estimates that each oil change will require 5 quarts of oil. Oil filters will cost $3.00 each. He must also pay The Fast 'n Clean Corporation a franchise fee of $1.10 per oil change, since he will operate the business as a franchise. In addition, utility costs are expected to behave in relation to the number of oil changes as follows:

Bill Braddock anticipates that he can provide the oil change service with a filter at $25 each.

Instructions

(a) Using the high-low method, determine variable costs per unit and total fixed costs.

(b) Determine the break-even point in number of oil changes and sales dollars.

(c) Without regard to your answers in parts (a) and (b), determine the oil changes required to earn net income of $20,000, assuming fixed costs are $32,000 and the contribution margin per unit is $8.

Definitions:

Administrative Agency

A government body responsible for implementing legislation, enforcing laws, and regulating activities within its jurisdiction.

Congress

The national legislative body of the United States, consisting of the Senate and the House of Representatives.

Funding

Funding refers to the financial resources provided for a specific purpose, such as running a project, a business venture, or a research initiative.

Administrative Agencies

Administrative agencies are government bodies responsible for the oversight and administration of specific functions, such as regulation and enforcement of laws within their specialization.

Q25: Under an effective system of internal control,

Q44: The weighted-average contribution margin ratio is<br>A) 37%.<br>B)

Q59: The costs that are easiest to trace

Q68: The contribution margin ratio increases when<br>A) fixed

Q77: In Moyer Company, the Cutting Department had

Q95: The presence of any of the following

Q97: Barnes and Miller Manufacturing is trying to

Q169: As compared to a low-volume product, a

Q188: A company is considering eliminating a product

Q200: A decision whether to sell a product