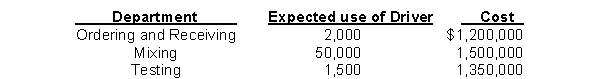

A company incurs $4,050,000 of overhead each year in three departments: Ordering and Receiving, Mixing, and Testing. The company prepares 2,000 purchase orders, works 50,000 mixing hours, and performs 1,500 tests per year in producing 200,000 drums of Goo and 600,000 drums of Slime. The following data are available:  Production information for Goo is as follows:

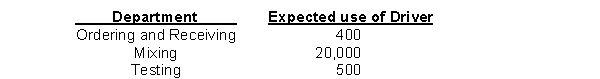

Production information for Goo is as follows:

Compute the amount of overhead assigned to Goo.

Definitions:

Income Statement

A financial statement that shows a company's revenues and expenses, and profits or losses over a specific period of time.

Relationship of Net Income to Net Sales

A profitability metric that measures the percentage of net sales that ultimately becomes net income, indicating the efficiency of a company in generating profit from sales.

Net Income

The total earnings of a company after all expenses and taxes have been subtracted from total revenue.

Net Sales

This refers to the revenue generated from sales after deducting returns, allowances for damaged or missing goods, and discounts.

Q20: Seaver Corporation manufactures mountain bikes. It has

Q33: Two of the activity cost pools for

Q72: Carlton Company has gathered the following information

Q81: The margin of safety is the difference

Q85: Kline Manufacturing has the following labor costs:

Q93: In a CVP income statement, cost of

Q109: Gant Accounting performs two types of services,

Q133: Price Company assigns overhead based on machine

Q139: What are the conditions that would indicate

Q157: Madison Industries has equivalent units of 8,000