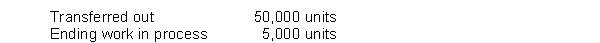

Glazer, Inc. has the following production data for June:

The units in work in process are 100% complete for materials and 60% complete for conversion costs. Materials costs are $3 per unit and conversion costs are $6 per unit.

Instructions

Determine the costs to be assigned to the units transferred out and the units in ending work in process.

Definitions:

Costs Added

The additional expenses incurred in the production process, including raw materials, labor, and overhead.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production, based on a specific activity base.

Job-Order Costing

An accounting method that tracks the costs associated with producing a specific batch of products or performing a specific service.

Manufacturing Overhead Costs

Indirect costs associated with manufacturing, including costs of running the factory, maintenance, and utilities, that cannot be directly traced to a product.

Q7: A major difference between the income statements

Q25: Each of the manufacturing cost components is

Q44: Which of the following is not a

Q54: The Nitrogen Fixation Department of Tomco Company

Q86: Sportly, Inc. completed Job No. B14 during

Q108: A CVP income statement is frequently prepared

Q116: A cost-volume-profit graph is frequently used in

Q158: Assuming that the total manufacturing costs are

Q182: Indirect materials and indirect labor are both

Q210: At the break-even point of 2,000 units,