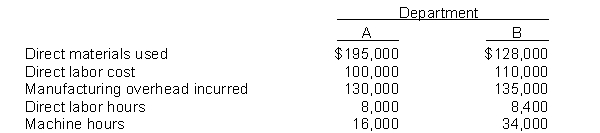

Landis Company uses a job order cost system in each of its two manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department A and machine hours in Department B. In establishing the predetermined overhead rates for 2017, the following estimates were made for the year:

During January, the job cost sheet showed the following costs and production data:

Instructions

(a) Compute the predetermined overhead rate for each department.

(b) Compute the total manufacturing cost assigned to jobs in January in each department.

(c) Compute the balance in the Manufacturing Overhead account at the end of January and indicate whether overhead is over- or underapplied.

Definitions:

Accrued Interest

Interest that has been incurred but not yet paid, typically recorded as an expense for the period it relates to.

Year-End

The conclusion of an accounting period, typically the end of the fiscal or calendar year, when companies finalize their financial statements.

60-Day Note

A financial instrument or a loan agreement that requires repayment of the principal amount along with any accrued interest within 60 days.

Note Receivable

A written promise that entitles the holder to receive a specified amount of money at a set date in the future, often bearing interest.

Q44: Which of the following is not a

Q61: There are no units in process at

Q79: Penner Company reported total manufacturing costs of

Q86: Data for the cost of direct materials

Q95: Danner Corporation reported net sales of $650,000,

Q164: Jensen Manufacturing Company makes specialty tools. In

Q165: The current assets of Orangette Company are

Q173: A company assigned overhead to work in

Q204: Listed below are current asset items for

Q205: If actual overhead is less than applied