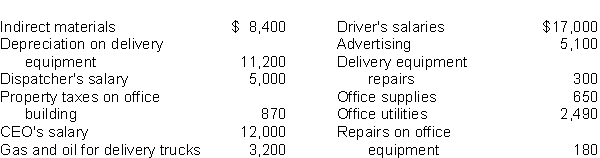

Kwik Delivery Service reports the following costs and expenses in June 2016.

Instructions

Determine the total amount of (a) delivery service (product) costs and (b) period costs.

Definitions:

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in product costs.

Production Cost

The total expense incurred in manufacturing goods, including materials, labor, and overhead costs.

Variable Overhead

The costs that fluctuate with the level of production or business activity, such as utilities or materials.

Variable Costing

A pricing approach that incorporates only those production expenses that vary—such as direct materials, direct labor, and variable manufacturing overhead—into the cost of products.

Q19: The statement of cash flows will not

Q38: When no-par value stock does not have

Q70: The following items were taken from the

Q134: Which of the following is not included

Q137: The total units to be accounted for

Q140: The predetermined overhead rate is based on

Q143: A process cost accounting system is appropriate

Q168: Manufacturing costs that cannot be classified as

Q173: Dolly's Dream Homes, Inc. manufactures doll houses

Q210: Dandy Candy Company sold its licorice division