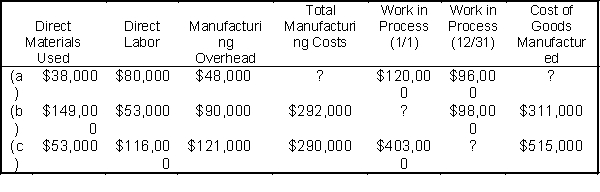

Presented below are incomplete 2013 manufacturing cost data for Tardy Corporation.

Instructions

Determine the missing amounts.

Definitions:

Sales Taxes Payable

Liabilities accounted for the sales tax collected from customers on taxable transactions, which are due to be paid to the relevant tax authorities.

Sales Tax Expense

The cost incurred by a seller related to the sales tax charged on goods or services, which is often passed through to the consumer.

Interest Charged

Interest charged is the amount lenders impose on borrowers for the use of borrowed money, often expressed as an annual percentage rate.

Interest Payable

An account representing the amount of interest expense that has been incurred but not yet paid by a company.

Q43: The production cost report summarizes the activities

Q58: Both direct labor cost and indirect labor

Q69: Planner Corporation's comparative balance sheets are presented

Q75: Minor Company had the following department data:

Q84: Hanker Company had the following department data

Q87: Charley Company's Assembly Department has materials cost

Q87: Jean's Vegetable Market had the following transactions

Q153: Hayward Manufacturing Company developed the following data:

Q172: The Assembly Department shows the following information:

Q174: The production cost report is an internal