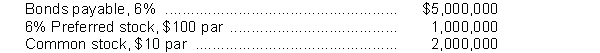

The balance sheet for Appalachian Corporation at the end of the current year includes the following:

Net income was $565,000 and income tax expense for the current year amounted to $285,000. Cash dividends paid on common stock were $200,000, and the common stock was selling for $28 per share at the end of the year. There were no ownership changes during the year.

Instructions

Determine each of the following:

(a) Number of times that bond interest was earned.

(b) Earnings per share for common stock.

(c) Price-earnings ratio.

Definitions:

Historical Rate

A reference to the exchange rate used in translating foreign currency amounts into the reporting currency for financial statements at a specific past date.

Temporal Method

A method of foreign currency translation that uses exchange rates based on the timing of the original transaction.

Property, Plant & Equipment

Long-term tangible assets used in the operation of a business that are not intended for sale, such as machinery and buildings.

Historical Rate

The exchange rate at which a foreign currency transaction was converted into the reporting currency at the time of the transaction.

Q38: When no-par value stock does not have

Q40: Karl Corporation was organized on January 2,

Q82: Inventory turnover is a measure of liquidity

Q118: Property taxes on a manufacturing plant are

Q120: Kong Inc. reported net income of $298,000

Q126: Using the indirect approach, noncash charges in

Q129: The information in a statement of cash

Q143: Vega Corporation's December 31, 2018 balance sheet

Q178: Restricted retained earnings are available for preferred

Q265: What is ordinarily the first step in