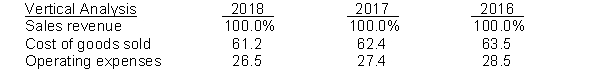

Vertical analysis (common-size) percentages for Austin Company's sales, cost of goods sold, and expenses are listed here.

Did Austin Company's net income as a percent of sales increase, decrease, or remain unchanged over the 3-year period? Provide numerical support for your answer.

Definitions:

Coverdell Education Savings Account

An investment account in the U.S. with tax benefits, intended to promote savings for future educational costs.

AGI

Adjusted Gross Income, which is gross income minus adjustments, and serves as a basis for calculating taxable income on an individual's tax return.

Qualified Higher Education Expenses

Expenses related to education, such as tuition and fees, required for enrollment or attendance at an eligible educational institution.

Nontaxable Distribution

A distribution or payout from an investment or account, such as a return of capital, that is not subject to income tax.

Q11: Comparisons of company data with industry averages

Q28: Product costs are also called inventoriable costs.

Q29: When the company assigns factory labor costs

Q63: Plexis Company reported net income of $148,000.

Q120: Kong Inc. reported net income of $298,000

Q140: In a common size income statement, each

Q145: The following information pertains to Blue Flower

Q238: A factor which distinguishes the corporate form

Q245: Tito Corporation had net income of $2,000,000

Q339: On September 5, Borton Corporation acquired 2,500