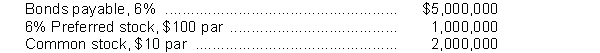

The balance sheet for Appalachian Corporation at the end of the current year includes the following:

Net income was $565,000 and income tax expense for the current year amounted to $285,000. Cash dividends paid on common stock were $200,000, and the common stock was selling for $28 per share at the end of the year. There were no ownership changes during the year.

Instructions

Determine each of the following:

(a) Number of times that bond interest was earned.

(b) Earnings per share for common stock.

(c) Price-earnings ratio.

Definitions:

Hypothetical Nations

Hypothetical nations are theoretical or imaginary countries used for the purpose of discussion, analysis, or illustration in economic or political scenarios.

Excise Tax

A tax on specific goods, such as alcohol and tobacco, often levied at the manufacturing level.

Imported Good

A product or service that is brought into one country from another, making it available for domestic consumption or use.

Protective Tariff

A tariff designed to shield domestic producers of a good or service from the competition of foreign producers.

Q3: Manufacturing overhead is applied to jobs by

Q44: The third (final) step in preparing the

Q92: The manufacturing operations of Beatly, Inc. had

Q95: Net income of a corporation should be

Q139: New Corp. issues 2,000 shares of $10

Q145: James Corporation has the following accounts at

Q158: Liquidity ratios measure the ability of the

Q172: Exeter Corporation had net income of $3,000,000

Q229: Treasury stock should not be classified as

Q282: Farmer Company reports the following amounts for