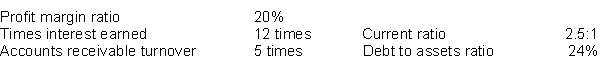

The following ratios have been computed for Southern Company for 2017.

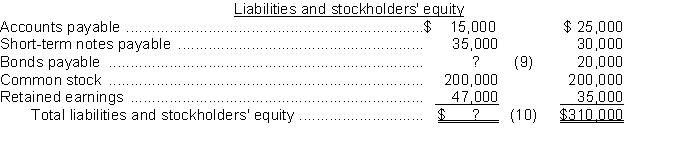

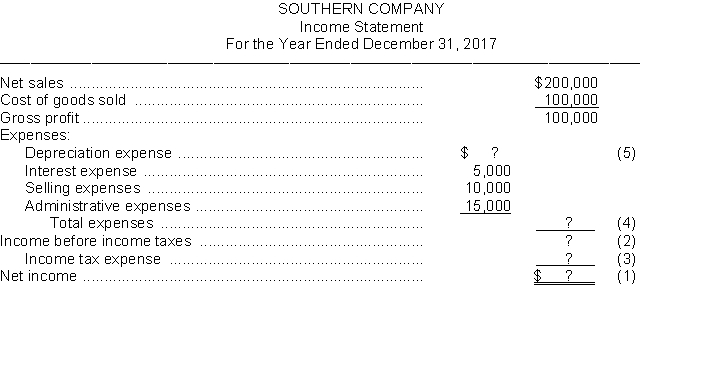

The 2017 financial statements for Southern Company with missing information follows:

Instructions

Use the above ratios and information from the Southern Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Definitions:

Weighted Average Cost of Capital

The average rate of return a company is expected to pay its security holders, weighted by the proportion of each security in the total capital structure.

Preferred Shares

Preferred shares are a type of stock that provides shareholders preferential payments of dividends and priority over common stock in asset liquidation, but generally do not carry voting rights.

Common Shares

Equities that represent ownership in a corporation, providing voting rights and a share in the company's profits through dividends.

Expected Rate of Return

The anticipated amount of profit or loss an investment is projected to generate, given certain assumptions.

Q2: The income statement for the Carolina Service

Q35: Jarrett Company issued 900 shares of no-par

Q43: A successful discount retail store such as

Q60: If a stockholder receives a dividend that

Q84: If the total manufacturing costs are greater

Q151: The asset turnover measures<br>A) how often a

Q161: Which of the following would be considered

Q173: Comparative information taken from the Bergeron Company

Q226: Savory Thymes, Inc. had net credit sales

Q264: A net loss<br>A) occurs if operating expenses