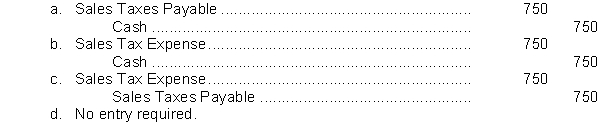

Ed's Bookstore has collected $750 in sales taxes during April. If sales taxes must be remitted to the state government monthly, what entry will Ed's Bookstore make to show the April remittance?

Definitions:

Ownership

The state or fact of legal possession and control over property, which includes the rights to use, sell, or lease it.

Deferred Income Tax Asset

A tax asset that reflects a company's ability to reduce future tax liability due to deductible temporary differences.

Consolidated Income Tax Return

A tax document filed by a parent company encompassing all of its subsidiaries, combining their financial statements for tax purposes.

Tax Rate

The percentage at which an individual or corporation is taxed. The tax rate can vary depending on income level, type of income, or type of goods.

Q7: Ralston Company is authorized to issue 10,000

Q10: Layton Inc. is considering two alternatives to

Q20: A 10% stock dividend will increase the

Q83: All of the following are intangible assets

Q91: On December 1, 2017, Crawley Corporation incurs

Q103: A corporation commits to a legal obligation

Q131: Equipment with a cost of $400,000 has

Q143: The Modified Accelerated Cost Recovery System (MACRS)

Q214: Rooney Company incurred $560,000 of research and

Q227: If a plant asset is retired before