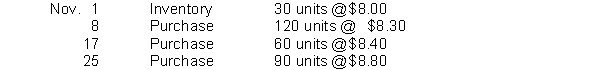

Netta Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Cost of goods sold (rounded to the nearest dollar) under the average-cost method is

A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Assume a periodic inventory system is used. Cost of goods sold (rounded to the nearest dollar) under the average-cost method is

Definitions:

AGI Deduction

A deduction from gross income to calculate Adjusted Gross Income (AGI), incorporating specific deductions like tuition fees or student loan interest.

Qualified Moving Expenses

Qualified Moving Expenses are those costs that are deductible when an individual relocates for employment reasons and meets certain distance and time tests defined by the IRS.

Temporary Storage Costs

Expenses incurred for storing personal property for a short period, possibly deductible under certain tax situations.

Modified AGI

An adjustment to adjusted gross income, including or excluding certain items, used to calculate eligibility for specific tax benefits.

Q37: The classified balance sheet is<br>A) required under

Q58: The Inventory account is used in each

Q112: In a single-step income statement, all data

Q117: Both IFRS and GAAP require disclosure about<br>A)

Q121: The income statement of Jue's Luggage includes

Q124: A post-closing trial balance will show<br>A) only

Q175: All reconciling items in determining the adjusted

Q183: Harnish Company needs to make adjusting entries

Q188: Current liabilities<br>A) are obligations that the company

Q220: On October 1, 2018, Ellington Company establishes