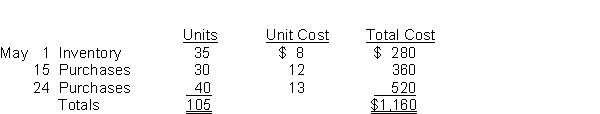

Ford Co. uses a periodic inventory system. Its records show the following for the month of May, in which 75 units were sold.

Instructions

Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Prove the amount allocated to cost of goods sold under each method.

Definitions:

Relevant Range

The range of activity or volume over which the assumptions about fixed and variable cost behavior are valid.

Fixed Costs

Costs that do not change with the level of output or sales in the short term, such as rent, salaries, and insurance.

Cost Behaviour

Cost behavior is the manner in which a cost changes as the related activity level or volume changes, typically classified into fixed, variable, and mixed costs.

Cost Estimation

The process of forecasting the likely costs of a project or production, based on various factors and historical data.

Q1: Garner Supply Company reports net income of

Q2: Every adjusting entry affects one balance sheet

Q27: Asset prepayments become expenses when they expire.

Q47: A liability-revenue account relationship exists with an

Q63: Under a voucher system, a pre-numbered voucher

Q77: Internal control is defined, in part, as

Q129: Gross profit does not appear<br>A) on a

Q148: Ezra Company has sales revenue of $60,000,

Q160: The following information was available for Pete

Q203: The final step in the accounting cycle