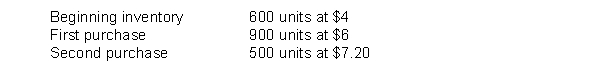

The following information is available for Yancey Company:

Assume that Yancey uses a periodic inventory system and that there are 700 units left at the end of the month.

Instructions

Compute the cost of ending inventory under the

(a) FIFO method.

(b) LIFO method.

Definitions:

Stockout Cost

The cost associated with running out of stock, including lost sales, backorders, and potentially reduced customer satisfaction and loyalty.

Inventory Holding Cost

Expenses related to storing unsold goods, including warehousing, insurance, depreciation, and opportunity costs.

Subcontractingcost

The expense incurred when a business hires outside contractors to perform tasks that could be done internally or as part of a project.

Inventory Holding Cost

Inventory holding cost refers to the total cost associated with storing unsold goods or materials, including warehousing, depreciation, insurance, and obsolescence costs.

Q11: A company's calendar year and fiscal year

Q38: Compute the lower-of-cost-or-net realizable value valuation for

Q49: IFRS, compared to GAAP, tends to be

Q51: Inventories are defined by IFRS as<br>A) held-for-sale

Q109: Hoppmann Company wrote checks totaling $25,620 during

Q111: The interest rate specified on any note

Q127: For each of the following, determine the

Q127: If a petty cash fund is established

Q143: A company just starting in business purchased

Q209: In preparing a bank reconciliation, outstanding checks