Selected transactions for Good Home, a property management company, in its first month of business, are as follows:

Jan. 2 Issued stock to investors for $15,000 cash.

3 Purchased used car for $5,200 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $2,100 for services performed.

16 Paid $450 cash for advertising.

20 Received $1,300 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Paid dividends of $2,000.

Instructions

For each transaction indicate the following.

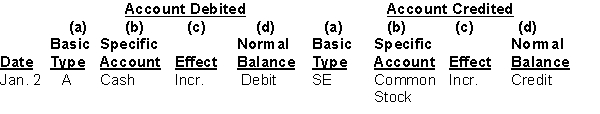

(a) The basic type of account debited and credited (asset (A), liability (L), stockholders' equity (SE)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Definitions:

Get & Transform

A feature in Excel that allows users to import, clean, and transform data from various sources for analysis.

Insert Table

An action or command in document processing and spreadsheet software that allows users to create a table structure within a document or sheet.

Promote

To support or actively encourage the progress, growth, or acceptance of something.

Demote

In organizational terms, to reduce someone's rank or position; in software or digital content creation, it refers to decreasing the importance or level of an item in a hierarchical structure.

Q24: The starting point of the accounting process

Q27: The amounts appearing in the Inventory column

Q50: An income statement<br>A) summarizes the changes in

Q78: The origins of accounting are attributed to

Q110: Prepare a corrected trial balance for

Q120: Which of the following would not be

Q160: Owners enjoy limited liability in a<br>A) proprietorship.<br>B)

Q176: Liabilities<br>A) are future economic benefits.<br>B) are existing

Q211: An accumulated depreciation account<br>A) is a contra-liability

Q212: Accrued revenues are<br>A) cash received and a