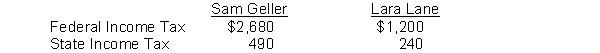

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:

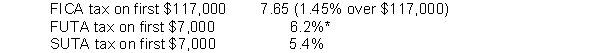

The following payroll tax rates are applicable:

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Definitions:

Central Selling Feature

A key attribute or benefit of a product that sets it apart from its competitors and is emphasized in marketing efforts.

Incentive

Something that motivates or encourages someone to do something.

Quick Action

Immediate or prompt response to a situation, often requiring decisiveness and efficiency.

Maslow's Hierarchy

A psychological theory proposed by Abraham Maslow that outlines a five-tier model of human needs, depicted as hierarchical levels within a pyramid.

Q17: Cash from sales of merchandise will be

Q22: A net loss will result during a

Q23: A change from LIFO to FIFO should

Q36: In a defined contribution plan, an employer

Q38: At the end of its first year,

Q52: Correction of an error involves corrections to

Q75: When the cost method is used to

Q82: On August 13, 2018, Swell Maps

Q165: The ledger accounts of the Fabulous

Q172: The organization(s) primarily responsible for establishing